Healthcare Recoupment Relief Program Frequently Asked Questions

Frequently asked questions about the Healthcare Recoupment Relief Program.

-

Who is eligible for this program?

-

How much money will I receive if I am eligible?

-

How do I know if I should use the Self-Certification or Document application for applying for this program?

-

If I have more than $10,000 in recoupment, can I submit the Self-Certification application for my first $10,000 in claimed COVID-19 related business expenses and then submit the Document application for expenses over that amount up to the total amount I have in recoupment?

-

What if I realize I made an error in my application after I have submitted it? How can I correct it?

-

My practice has over $10,000 in recoupment and is using the Document application to claim COVID-19 related business expenses in excess of $10,000, what level of documentation is required?

-

How will I know if I still remain in recoupment after applying for relief in this program?

-

Can I claim payroll costs?

-

We were never closed, but still had increased expenses for PPE, social distancing, and other COVID-19 costs that we have not claimed before. Can we still obtain the offset?

-

What are the types of increased costs of doing business as a result of COVID-19 that are allowed?

-

My practice anticipates additional expenses in the rest of 2021, can we claim expenses not incurred yet?

-

My practice has had increased operational costs because we expanded, can we claim the cost of expansion?

-

My practice invested in infrastructure prior to March 1, 2020 that has assisted us in responding to COVID-19, can we claim those costs?

-

I want to submit more than one document in the required documents fields, but do not seem to be able to do that. How can I submit additional documents?

-

Who is eligible for this program?

This program is only open to Healthcare System Relief Fund awardees that are notified by GOFERR that their reporting indicates that they owe recoupment per federal requirements, because their actual revenue losses and reported 2020 COVID-19 related expenses do not cover the full amount of their award(s).

-

How much money will I receive if I am eligible?

Eligible Healthcare Recoupment Relief Program awardees will not receive any additional funding. However, they can cover up to the full amount of their 2020 award(s) that is in recoupment by claiming qualified COVID-19 related business expenses that have not previously been claimed that are incurred by July 28, 2021.

This Recoupment Relief program modifies the terms of the initial 2020 awards to allow COVID-19 expenses, including 2021 COVID related expenses incurred up to the date the program opens, to offset up to the full amount in recoupment. No new awards will be issued and no payments will be made, this is an offset program only.

-

How do I know if I should use the Self-Certification or Document application for applying for this program?

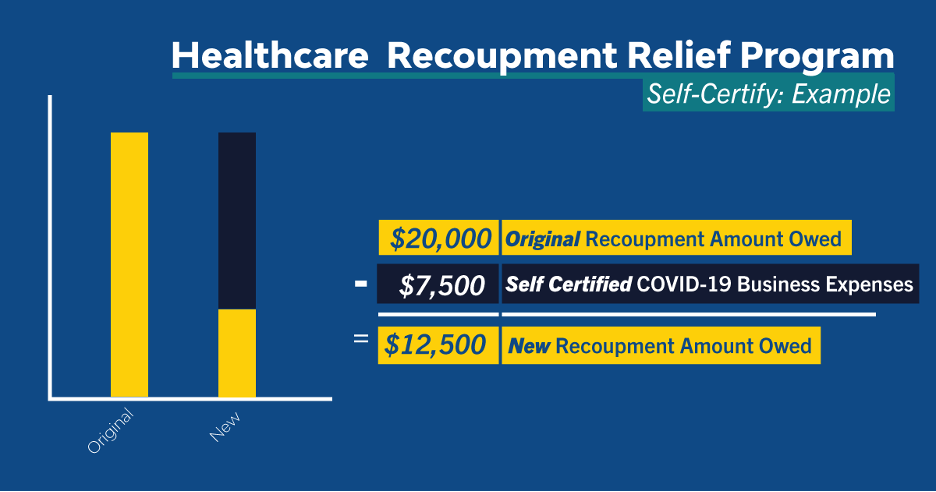

Self-Certification is for providers that are notified that they have recoupment that wish to claim $10,000 or less in qualified, previously unclaimed COVID-19 related business expenses.

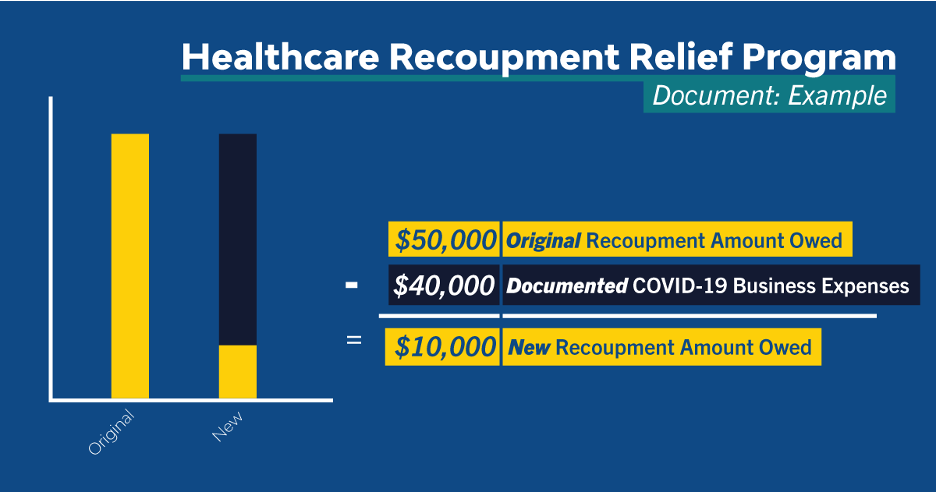

The Document application is for providers that are notified that they have recoupment that wish to claim more than $10,000 in qualified, previously unclaimed COVID-19 related business expenses. (A list of eligible expenses is included below).

-

If I have more than $10,000 in recoupment, can I submit the Self-Certification application for my first $10,000 in claimed COVID-19 related business expenses and then submit the Document application for expenses over that amount up to the total amount I have in recoupment?

No, you cannot file two applications, but you can choose whichever application is most appropriate for your business.

If you claim $10,000 or less in expenses, you may submit a Self-Certification application. If you claim more than $10,000 in expenses you should submit a Document application.Because only one application will be processed, you should not submit your application until you are certain it is complete and you have the correct documents (if required) ready to upload as you will not be able to make changes after submission. You can save your application and finish it later, if needed.

-

What if I realize I made an error in my application after I have submitted it? How can I correct it?

Because only one application will be processed you should not submit your application until you are certain it is complete and you have the correct documents (if required) ready to upload as you will not be able to make changes after submission. You can save your application and finish it later, if needed.

If you realize that you made an error or omitted a document before the application period closes and before you have received notice of the results of your application, you may submit a new application that contains the correct information. If there are multiple applications for an entity when GOFERR reviews them, GOFERR will assume that the application filed last in time is the most complete and will only process the last submitted application.

GOFERR will not process subsequent applications after notice of your results has been sent. If you believe you made an error in the information you provided in your application that might have impacted your eligibility, information regarding how to submit an appeal will be contained in the notice of results.

-

My practice has over $10,000 in recoupment and is using the Document application to claim COVID-19 related business expenses in excess of $10,000, what level of documentation is required?

You should submit your 2019, 2020, and 2021 expenses such as QuickBooks expense ledgers or other types of accounting software as they are kept in your normal course of business that itemize expenses. If you do not use any type of accounting software to track expenses you will need to submit copies of actual paid invoices or payments.

Please convert your documentation to a PDF format. Such documentation must be legible.

-

How will I know if I still remain in recoupment after applying for relief in this program?

Your eligible expenses will be deducted from the amount you owe in recoupment. If you have more in recoupment than you have in eligible expenses, you will only owe the balance. Please see the visual demonstrations below on how the program works and examples of instances in which a business might still have recoupment. You will receive a further notice of the result, including the new amount, if any.

-

Can I claim payroll costs?

No. Regular payroll costs will not be allowed as offsetting expenses. Some specific increases in payroll costs may be allowable, but only if they have not been previously claimed and if they have not been covered by any Payroll Protection Program loan.

-

We were never closed, but still had increased expenses for PPE, social distancing, and other COVID-19 costs that we have not claimed before. Can we still obtain the offset?

Yes, this program allows you to claim increased costs of doing business as a result of COVID-19.

-

What are the types of increased costs of doing business as a result of COVID-19 that are allowed?

The following is a non-exclusive list of examples related to all of the expense-category questions within the application. If an item fits within more than one example it may only be claimed once.

Potential COVID-19 related expenses (general list; not exhaustive):

- Prorated Rents, mortgage payments and utility costs for business property (not home offices) for the

- period an awardee was/is closed to the public due to COVID-19.

- Reopening to the public costs after a closure due to COVID-19 including:

- Displaying and/or communicating safety requirements for public access Marketing to announce reopening

- Restocking costs

- Increased cleaning and sanitation charges

- Creation or expansion of contactless ordering systems Increased use of disposable products

- Signage concerning COVID requirements

- Equipment costs related to new or expanded use of outdoor space including tents, heaters, tables, and chairs

- Costs for the purchase of items or equipment to protect the public and employees from the spread of COVID-19:

- Protective masks

- Hand sanitizer

- Personal protective equipment

- Testing supplies

- Air filtration system improvements

- Increased workforce and trainings on safety

- Plexiglas barriers

- Installing physical safety measures meant to protect the public and employees from the transmission of COVID-19 in order to reopen a business

- Capital improvement costs necessary to provide social distancing such as:

- Room dividers

- Adding space to an existing building

- Creating outdoor space to increase social distancing options

- Tents and heaters for providing outdoor services

- Rental of additional space to serve the same number of clientele

- Expenses incurred to facilitate compliance with COVID-19-related public health measures such as:

- Distance learning

- Telehealth, telework

- Additional paid sick and family and medical leave

- Increased workforce and trainings on safety

- Creating indoor or outdoor space to increase social distancing options including tents and heaters for providing outdoor services.

-

My practice anticipates additional expenses in the rest of 2021, can we claim expenses not incurred yet?

No, the offset must be for reimbursement of expenses that have been incurred and paid between March 1, 2020 and the July 28, 2021, the beginning date of the application period.

-

My practice has had increased operational costs because we expanded, can we claim the cost of expansion?

Generally, no. If an expansion was planned before March 1, 2020 or has no relation to responding to COVID-19, it cannot be claimed. Only if an expansion was directly related to responding to an increased COVID-19 related need could the increased operational cost for an expansion be claimed.

For example, if your practice delivered home healthcare services that experienced increased demand for your services or products to support existing or new clients because of the pandemic and had to expand, after April of 2020, other expenses will be allowed as long as there is a direct relationship to responding to COVID-19, except for regular payroll costs which are not allowed.

Additionally, if your business physically expanded in 2020 or 2021 due to COVID-19 related requirements, and that expansion resulted in increased operational costs, both the expansion costs and increased operational expenses could be claimed.

-

My practice invested in infrastructure prior to March 1, 2020 that has assisted us in responding to COVID-19, can we claim those costs?

No, due to restrictions in the CARES Act we cannot allow expenses incurred prior to March 1, 2020.My practice invested in infrastructure prior to March 1, 2020 that has assisted us in responding to COVID-19, can we claim those costs?

-

I want to submit more than one document in the required documents fields, but do not seem to be able to do that. How can I submit additional documents?

There are several options. Some users have reported that each field is limited to one document, but there is no size limit on the document, so you can combine your documents into a multiple page file and upload it as one document.

If you do not have software to combine PDFs this can be done by printing the documents and copying them together as one document on a copier to pdf. Alternatively, below the required document fields, there is an “optional documents” field that provides the ability to upload up to three optional documents. If these options do not work for you, please contact info@goferr.nh.gov.